The handset market in the United States in the first quarter grew 12% over the year-ago quarter, with the sale of about 39 million units valued at nearly $3 billion, according to The NPD Group. That growth is roughly similar to the year-ago quarter’s 11% growth.

The handset market in the United States in the first quarter grew 12% over the year-ago quarter, with the sale of about 39 million units valued at nearly $3 billion, according to The NPD Group. That growth is roughly similar to the year-ago quarter’s 11% growth.In a reversal of global trends, Motorola Inc.’s market share in its home market grew to 35% in the first quarter, up from 29% in the year-ago quarter, while global leader Nokia Corp.’s share sank from 19% to 10% in the same period. (Globally, Nokia is forecasting a market share increase to about 36% this year, while Motorola has dropped from about 21% to 17%.)

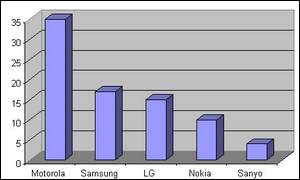

The first-quarter figures from NPD reflect that Nokia fell to No. 4 in the U.S. this year from No. 2 last year, allowing Samsung Electronics Co. Ltd. and LG Electronics Co., with static market shares, to move into the No. 2 and No. 3 spots, respectively, with 17% and 15% shares. Sanyo Corp., which sells handsets exclusively through Sprint Nextel Corp. and some of its mobile virtual network operator partners, garnered No. 5 in the first quarter with 4% market share, displacing Kyocera Wireless Corp., which had been No. 5 last year with a similar share.

Ross Rubin, director of wireless analysis for NPD, said that the first quarter did not reflect a significant drop in handset sales from the preceding quarter (Q4 2006), which includes the typically hot holiday season. American consumers appeared to embrace mobile music and the accessories that enable it, such as Bluetooth headsets and removable memory, Rubin said.

Handset sales are increasingly the domain of network operator retail stores; their share of sales rose to 63% in the first quarter from 60% in the year-ago quarter. This may increase the U.S. market share challenge for Nokia, which recently reiterated its dedication to meeting the needs of top-tier carriers, and for Sony Ericsson Mobile Communications, which does not appear in NPD’s top five list this year or last. Both Nokia and SEMC have struggled to gain traction in the top-tier carriers’ portfolios and thus rely more heavily than competitors on alternative distribution channels.

NPD’s top five for first-quarter 2007 are: Motorola (35%), Samsung (17%), LG (15%), Nokia (10%) and Sanyo (4%).

No comments:

Post a Comment